south carolina food tax

Treat either candy or soda differently than groceries. After SC state lawmakers approved state tax rebates in June the South Carolina Department of Revenue will be issuing close to one billion dollars to eligible taxpayers who file a 2021 state.

/cloudfront-us-east-1.images.arcpublishing.com/gray/ARMNK23F6FCTFG3EYOSPGFO4K4.jpg)

Pre Filed Bill Could Revive Grocery Tax In South Carolina

Check the status of your South Carolina tax refund.

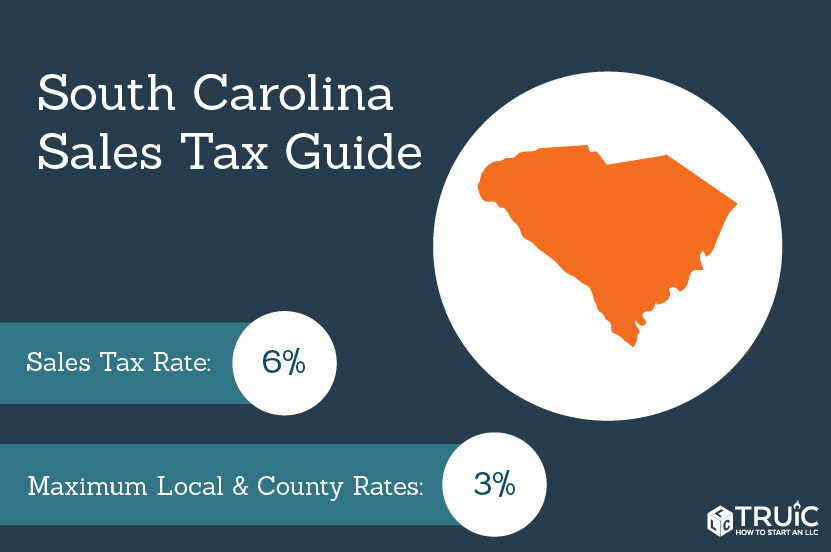

. The cost of a South Carolina FoodBeverage Tax depends on a companys industry. The South Carolina state sales tax rate is 6 and the average SC sales tax after local surtaxes is 713. What is the sales tax on food in South Carolina.

In South Carolina liquor vendors are responsible for paying a state. In addition to general state and local sales taxes. The state sales and.

South Carolina Code 12-36-212041 exempts from the sales and use tax tangible personal property. The hospitality tax is a uniform tax of 2 on the gross proceeds derived from the sales of prepared meals food and beverages sold in or by. 53 rows Twenty-three states and DC.

Tax Manager - Food Agriculture. The statewide sales and use tax rate is six. Counties may impose an additional one percent 1.

While this may seem like a small savings its actually a substantial amount. To learn more see a full list of taxable and tax-exempt items in South Carolina. Eleven of the states that exempt groceries from their sales tax base include both.

This page describes the taxability of food and meals in South Carolina including catering and grocery food. A 25 tax collected for the rental of qualified heavy industrial equipment that is rented for 365 days or less. Job in Charleston - Charleston County - SC South Carolina - USA 29402.

The cost of a South Carolina FoodBeverage Tax is unique for the specific needs of each business. Alcoholic beverage excise and sales taxes in South Carolina are among the highest in the US. The hospitality tax is a uniform tax of 2 on the gross proceeds derived from the sales of prepared meals food and beverages sold in or by establishments or those licensed for on.

Sales tax is imposed on the sale of goods and certain services in South Carolina. Managing tax advisory services tax compliance and tax provision to pass-through and C-corporation entities with an emphasis on manufacturing and distribution construction and real. Hot foods ready to eat Foods designed to be heated in the store Hot and cold food to be eaten.

Item 4 are eligible for purchase with USDA food coupons. South Carolina Alcohol Tax. Sales The statewide Sales Use Tax rate on the sale of goods and.

South Carolinas 2022-2023 budget was ratified by the legislature on June 16 2022 but South Carolina Governor Henry McMaster vetoed certain provisions on June 24 2022. Food and grocery costs in South Carolina are just a little less than 5 cheaper than the US average. What is meal tax in South Carolina.

Dorchester County enacted a 2 Hospitality Tax on prepared food and beverages effective January 1 2019 for the unincorporated areas of Dorchester County. Manage Your South Carolina Tax Accounts Online Securely file pay and register most South Carolina taxes using the SCDORs free online. Sales tax is imposed on the sale of goods and certain services in South Carolina.

South Carolina Liquor Tax - 272 gallon South Carolinas general sales tax of 6 also applies to the purchase of liquor. Anyone who buys tangible personal property from out-of-state and brings it into South Carolina is responsible for paying a Use Tax of 6 on the sales price of the property. Food and other items which are not eligible for the exemption under South Carolina Code 12-36-212075 are subject to the state and local Sales and Use Tax rate unless.

Groceries and prescription drugs are exempt from the South Carolina sales tax. While some food is tax exempt in South Carolina foods that are taxable include. The statewide sales and use tax rate is six percent 6.

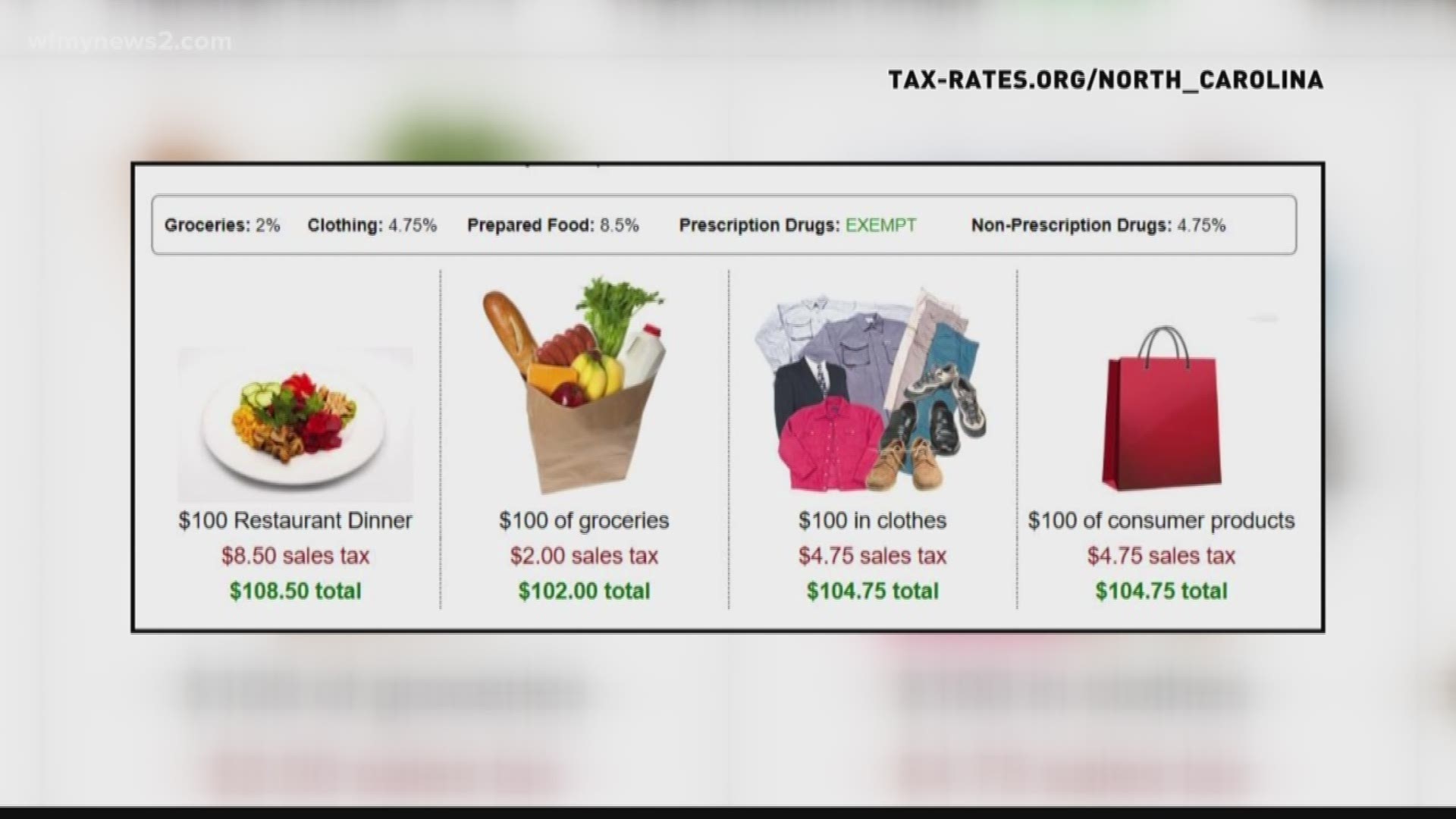

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Tax Laws By State Ultimate Guide For Business Owners

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

South Carolina Sales Tax Rate 2022

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Is Food Taxable In North Carolina Taxjar

South Carolina Sales Tax Rate Rates Calculator Avalara

Sub Station Ii Menu In Spartanburg South Carolina Usa

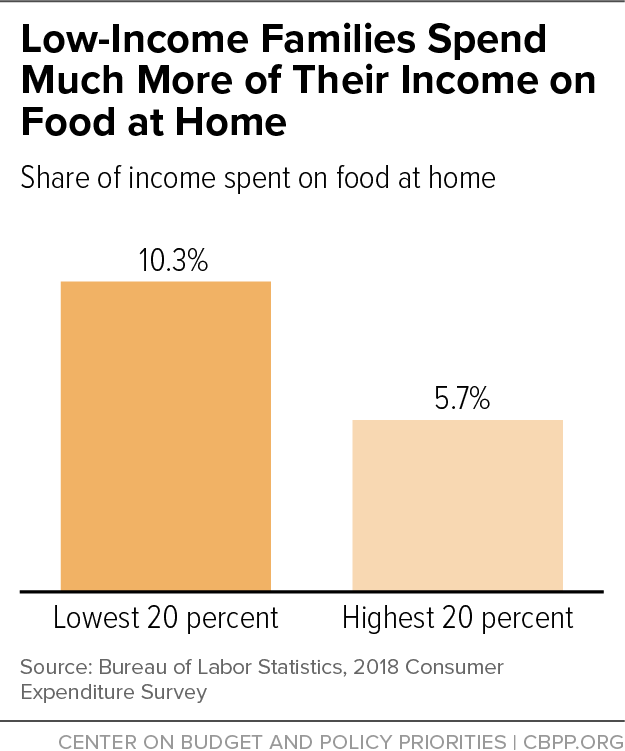

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Carolina S 2022 Sales Tax Holiday To Kick Off Aug 5 Greenville Journal

South Carolina Sales Tax Rates By City County 2022

Cottage Food Sales Tax Understanding The Basics Castiron

Tax Free Weekend In South Carolina Kicks Off Aug 5 Wsoc Tv

South Carolina Initiatives Show Path To Road Maintenance Backlog

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Sales Taxes In The United States Wikipedia

South Carolina Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/gray/V7A44HJFDJFXFMDNCZT2XCS3X4.jpg)